Ensuring a steady supply of food in Iran often requires importing essential commodities, especially when faced with shortages or the impact of factors such as seasonal changes or inadequate local cultivation.

The process of importing and clearing food from the country’s customs is of great importance. Due to the perishable nature of many of these goods, it is necessary to carry out the steps of food import and clearance under the strict supervision of the National Standard Organization. In the future, stay with Tejarat Joyan Trading Company and let’s check the important thing.

Product health approval by this organization is a prerequisite and failure to comply with these standards can lead to complications in the customs clearance process.

To overcome these complexities, it is recommended to rely on specialized services for food clearance. Bandar Abbas customs appears as a central player in this field. This customs, which is located near the Persian Gulf, has become one of the most important points of entry into Iran.

Having strategic importance, Bandar Abbas Customs serves as a key stop for commercial ships and plays a pivotal role in the flow of imported goods.

The strategic importance of Bandar Abbas customs is increased due to its location near Qeshm Island and it contributes greatly to its commercial importance. This customs facility not only facilitates the efficient movement of goods, but is also seen as one of the busiest commercial routes in the country.

The intersection of strategic location and bustling maritime activities makes Bandar Abbas Customs a hub in Iran’s import and clearance operations, especially for essential food items.

How is the import and clearance of food from Iranian customs?

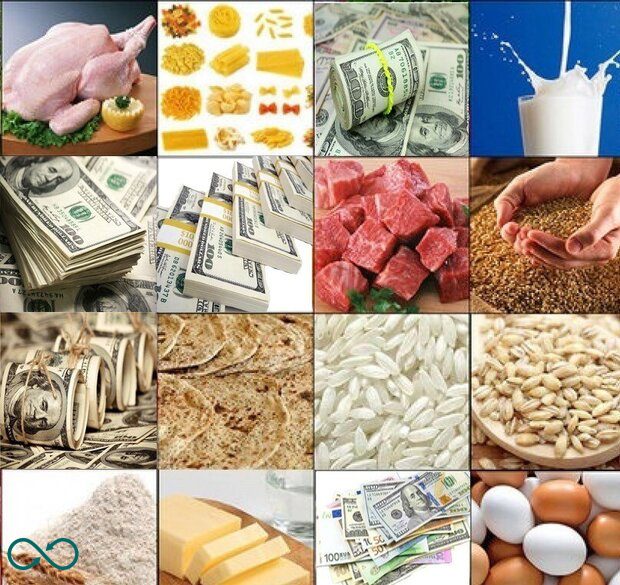

Importing food to Iran includes a wide range of items, including spices and condiments and various foods. Products such as pasta, various sauces, some dairy products, canned goods, sausages and sausages, chocolate, import and clearance of coffee and even snacks such as puffs, chips, rice, all kinds of red and white sweets are also regularly imported into the country.

It is important to emphasize that the import and trade of these food products in Iran requires strict compliance with a set of regulations that are usually managed through food clearance procedures.

Most of the European countries actively import food to Iran and strengthen mutual relations in which food is also exported to European countries, Afghanistan, Iraq and the United Arab Emirates.

However, the sensitive nature of food products, with the risk of corruption during international transportation, clearance and customs formalities, underscores the importance of seeking the expertise of professional food clearance services to navigate potential challenges during the clearance process. .

Clearance of food from Iranian customs is under special rules, which are divided into three separate categories: permitted goods, unauthorized goods, and conditional goods. Authorized goods do not require additional permits for import and clearance.

The entry of unauthorized goods into the country is strictly prohibited. It is worth noting that food products are subject to conditional goods and require both sanitary and standard permits for successful importation and clearance. Food clearance costs are determined based on factors such as volume, amount and type of goods.

Understanding these categories and requirements is essential for businesses and people related to food import and clearance in Iran and emphasizes the need to pay close attention to compliance and use specialized food clearance services to facilitate a smooth and problem-free process.

Documents required for food clearance

To facilitate the clearance of food from customs, a detailed process including necessary documents and the involvement of the owner or legal representative is necessary. The necessary documents are generally classified into the following:

1. Documents related to goods:

Clearance: This includes general clearance documents.

Warehouse receipt: a document confirming the storage of goods in the warehouse.

Bill of Lading: A comprehensive document that describes the key specifications of the goods, including the number of containers, package details and net weight.

Proforma or pre-invoice: providing vital information such as seller’s address, buyer’s name, type and quantity of goods, unit price and total cost.

Goods invoice: An invoice that shows the details of the goods, their quantity and related costs.

Packing list: It is used when the imported product has multiple packages with different contents.

Certificate of Origin: An essential document that specifies the characteristics of the purchased goods, the country of manufacture and relevant information issued by the country’s Chamber of Commerce.

Registration of commercial orders: food import permits to Iran, which are often obtained from the embassy.

Commodity insurance policy: If available, this document serves as an initial record for ordering the product and insures the product against potential risks. It must have a date equal to or before the date of shipment of the product and the insurance value must be at least equal to the total value of the goods.

Certificate of standard and inspection of goods: indicates compliance with the standards set for imported goods. Goods Inspection An authorization issued by a trade organization, this document confirms that the registered and shipped goods conform.

Legal Permits: Obtaining permits related to health, standards, atomic energy, culture, guidance, etc. is vital for customs clearance.

Documents required by the owner of goods for food clearance

Presenting a valid business card is an essential step in customs authentication processes. It is important to emphasize that both the clearance of food from customs and the import of food to Iran require the presence of a commercial card. This central document is officially issued by the Chamber of Commerce, Industries and Mines.

It is equally necessary to present the original national ID card during the food clearance trip. In addition, a comprehensive submission includes a copy of all business card pages for detailed review. Additionally, providing a copy of the full page of the owner’s ID card adds an additional layer of verification.

The business card issued by the Chamber of Commerce serves as a key identifier and verifies the legitimacy of the business involved in the import or clearance process. This demonstrates compliance with business standards and regulations. The original national card serves as the primary form of personal identification of the people involved in the transaction and further confirms the authenticity of the documents provided.

Documents required by the representative of the goods owner or work clearance

The documents required for food clearance services to successfully navigate the customs process include several key components. This includes:

Original and copy of national card:

Providing the original national card as a form of primary identification for people involved in the food clearance process. Duplicate copy provides a comprehensive record for customs clearance.

Original notarized power of attorney:

A basic legal document that gives the authorized representative the authority to act on behalf of the entity or individual involved in the food clearance process. The notarial document guarantees the authenticity and validity of the document.

Providing a copy of the power of attorney or its copy:

Submission of this document is an essential requirement that serves as a verified record to prove the legality and correctness of the clearance procedures. This document indicates compliance with legal standards in the clearance process.

Copy of introduction letter:

An important element of the documentation, the letter of introduction provides details of the importer or the body responsible for food clearance. This additional information will assist the customs authorities in verifying the authenticity of the clearance request.

copy of notebook:

Providing a copy of the logbook is an integral part of the documentation process that provides comprehensive insight into the nature and details of the food being cleared. This leaflet usually contains specifications about the type, quantity and details of the imported food.

Important tips for food clearance from Iranian customs

Traders who wish to participate in the import of food for the Iranian market must be aware of the strict licensing process. In order to obtain the necessary license to import food in Iran, it is necessary to follow certain procedures.

Individuals are required to personally present the requested documents to the Health Committee and carefully separate these documents to be submitted to the General Directorate of Food and Drug Products.

This multi-faceted process requires careful review by the Health Legal Committee, which carefully evaluates submitted documents. It is important to mention that these documents must be finally approved by the Health Committee in order to place orders for food production for the Islamic Republic of Iran.

The presented documents have a central role in establishing the legitimacy and compliance of the proposed food production activities. Personal interaction with the health committee emphasizes the importance of transparency and commitment to regulatory standards in the production process. The subsequent review by the Health Legal Committee serves as a quality control measure and ensures that the proposed food production complies with the established health and safety regulations of the Islamic Republic of Iran.

Understanding the complex process of food clearance from customs in Iran involves an important step: obtaining a license to import food from the respective countries of origin. This key license is issued by the health committee, emphasizing the importance of compliance with health and safety standards in food imports.

With the successful approval and review of the documents, the import of food to Iran will begin. However, it is important to acknowledge that documents that are problematic or not approved by medical and health authorities can lead to complications during the importation process. Consequently, entrusting food clearance to professionals is highly recommended to effectively navigate potential challenges.

It is necessary for traders who intend to carry out integrated food clearance to follow certain points and provide necessary documents. To start the process, the importer must submit a written application for the issuance of a food clearance license from customs with an official stamp and signature of the CEO of the importing organization.

During the food clearance process at the customs, the trader must ensure the existence of the original invoice stamped with the official letterhead. It serves as an important document to verify the legitimacy and details of imported goods.

Also, it is mandatory for merchants applying for food import license to Iran to submit the original invoice and proforma invoice along with two letterhead images from the goods producers organization. This comprehensive documentation is reviewed by the health committee to ensure that the proposed food import meets the prescribed health and safety standards.

In essence, a careful approach to documentation and compliance with regulatory requirements not only facilitates the importation process, but also reduces the risk of complications. The participation of health committees emphasizes the commitment to ensure the health and safety of food supply in Iran and emphasizes the importance of adhering to established protocols and requesting expert assistance in the clearance process.

Food clearance customs tariffs

Each product that enters the country is assigned a specific customs tariff code, the classification of which can be determined based on the predefined categories and rows included in the export and import regulations. Due to the wide variety of food products, people looking to import food into the country are faced with the important task of accurately identifying the customs tariff code during the clearance process. Choosing the wrong code may cause complications for the product owner, which emphasizes the importance of accuracy in this aspect.

To effectively navigate this complex classification system, it is recommended that those who intend to import food, use the expertise of experienced and professional consultants as well as clearance agents. These people have in-depth knowledge of the regulations and nuances of customs tariff codes for various food items. Their guidance ensures that the correct code is applied and minimizes the risk of mistakes that could lead to delays, fines or other complications during the customs clearance process.

The process of determining the customs tariff code includes referring to the book of export and import rules and regulations. This resource specifies specific categories and rows that help classify each product accurately. The diversity of food products, from perishables to packaged goods, emphasizes the need for careful code selection.

Basically, using the expertise of clearance consultants and specialists not only simplifies the clearance process, but also protects the interests of the goods owner. It reduces the potential challenges associated with incorrect code selection and contributes to a more efficient and error-free import process for food products.